Securing our Future

What is Planned Giving?

Many donors pledge future support through bequests in their will and personal trusts, such as Revocable Trusts, Family Trusts, or Charitable Trusts with may offer additional tax benefits. These planned gifts, also known as Legacy Gifts, are most often fulfilled upon the person’s passing. This planned giving provides a unique opportunity for you to create a lasting legacy for charities you care about. It provides a way for you to pass on your values and beliefs, what you have found to be the most worthy of preserving for future generations. You can consult with your attorney, estate or financial planner, or CPA to arrange a simple change to your will or trust. To support this effort, our board can engage a network of attorneys to help achieve your goals.

Another type of planned gift may occur during our lives, and we may get to see an immediate benefit of that gift, it is very satisfying to see our money achieve present and timely results, much like the student sponsorships that we currently offer.

Additionally, planned gifts are a way to achieve certain charitable and financial planning goals and may yield certain federal tax advantages.

WHO CAN GIVE?

Everyone is welcome and invited to give. Often, people think “‘Oh, I am not wealthy, I do not have a large estate. I cannot make a large contribution.” However, people from all walks of life can make a planned gift, large or small, not just the wealthy.

WHAT CAN I GIVE?

When most people think of making a gift, they think of writing a check or using a credit card. But Planned Gifts are usually made from people’s assets as appreciated securities like stocks bonds, retirement plan assets, insurance policies, or real estate.

HOW DO I MAKE A PLANNED GIFT?

To make a planned gift to Mother Miracle School, designate your request to our Mother Miracle Inc. charity, a 501(c)(3) non-profit organization based in the USA. When writing a gift into your will or living trust requires specific language that accurately identifies your gift. If you already have a will or living trust that does not include Mother Miracle, you can just add an amendment to it, making a simple request. To support this effort, our board can engage a network of attorneys to help achieve your goals.

YOUR LEGACY IS OUR LEGACY.

A legacy gift is an important type of philanthropy. It provides for the perpetuity of the school for the benefit of future generations. As a provider of free private education, Mother Miracle depends on such gifts. Some people have already had the foresight to include Mother Miracle in their estate plans, wills, and trusts. Your gifts are vital in generating a substantial and perpetual stream of support, endowing the school for the future. Your legacy gift will make a difference for generations of students to come.

Please contact Tom Duffy, Board of Directors, for more information.

Tom Duffy, Board of Directors, Mother Miracle Inc, a 501(c)3 educational Non-Profit

In 2018, Tom and his wife Karen visited Rishikesh and Mother Miracle School. They met Shahla Ettafagh, the school Founder, and immediately sponsored students. Soon after, Shahla invited him to join the Board of Directors and help develop a plan to sustain the school for future generations. Tom has a background in financial planning services and investments. He now enjoys life as a real estate broker in New England and as Granddad to his seven grandchildren.

Donate

Choose to donate monthly or just one time.

Creating lasting change for a child and the

Rishikesh community in India.

Sponsor a Child

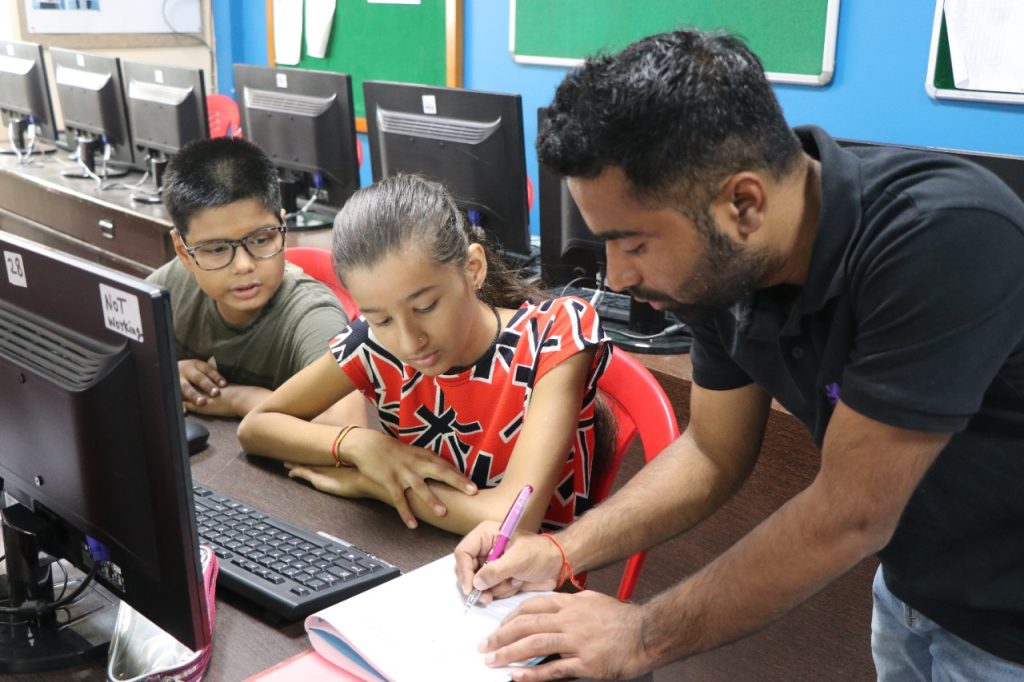

Behind the eyes and smiles of our children, there lies a remarkable story. Sponsor a child and help break the cycle of poverty.

Volunteer

We invite anyone with an open heart and a desire to serve to join us in the beautiful city of Rishikesh as a long-term volunteer.